News

Worldwide K-Beauty Platform SILICON2

Silicon2 'First K-Beauty Platform to Challenge 1 Trillion KRW in Sales'

[Korea Economic Daily] Silicon2 "First K-Beauty Platform to Challenge 1 Trillion KRW in Sales"

https://www.hankyung.com/article/2025052791331 (You can check the original article from the media outlet by clicking the link.) |

“Although we have grown through K-Beauty alone, we will create synergy with K-Pop and K-Food going forward.”

Silicon2, which recorded nearly 700 billion KRW in sales last year through Korean cosmetics exports, was established with the goal of building a new K-Culture platform. The ambition is to create a space where consumers can experience not only cosmetics but also food and music all in one place. Kim Sung-woon, CEO of the KOSDAQ-listed Silicon2, said, “We will become a Coupang-like platform company in the cosmetics industry by expanding our overseas logistics infrastructure,” adding, “This year, we plan to achieve sales of 1 trillion KRW.”

Sales Increased Fivefold in Three Years

Silicon2 is a distribution company exporting Korean cosmetics. It operates logistics centers not only in Korea but also in the U.S., Indonesia, Malaysia, Dubai in the UAE, Poland, and Vietnam. The company has partnerships with about 3,000 global major distributors including Sephora, Ulta, Costco, and Watsons, exporting K-Beauty products worldwide.

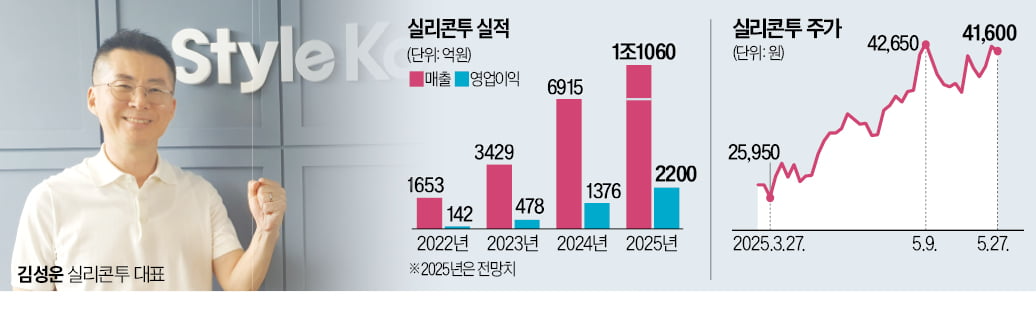

Riding the wave of K-Beauty’s popularity, Silicon2 has set new sales records every year. Sales rose from 131 billion KRW with operating profit of 8.8 billion KRW in 2021 to 691.5 billion KRW in sales and 137.6 billion KRW in operating profit last year — increases of 428% and 1,464%, respectively. In the first quarter of this year, it recorded sales of 245.7 billion KRW (up 63.9% YoY) and operating profit of 47.7 billion KRW (up 62.1%), making it highly likely to set a new annual record. The company’s goals for this year are sales of 1 trillion KRW and operating profit of 180 billion KRW.

Kim emphasized, “We have been able to grow rapidly by aggressively investing in overseas logistics infrastructure and conducting media marketing centered on diverse K-Beauty brands and stories,” adding, “We also contribute to raising the awareness of various small and medium-sized K-Beauty brands through content planning optimized for global marketing.”

Kim cited two main reasons for K-Beauty’s popularity: excellent cost performance (price-to-performance ratio) and the rising global affection for Korean culture. He said, “Korean cosmetics are generally priced between $15 and $25 but have quality comparable to premium French brands,” adding, “They are virtually unaffected by U.S. tariffs.” Even if a 10% tariff is applied to a $15 cosmetic product, the price only rises to about $17. Because Korean cosmetics remain cheaper than other countries’ products while delivering superior performance and image, consumers inevitably choose K-Beauty, according to Kim.

Strengthening K-Food Related Businesses

Silicon2 plans to strengthen its K-Food and K-Pop businesses. The company’s recent equity investment in the music chart platform ‘Hanteo Chart’ is aimed at creating synergy with its existing business. Kim explained, “For K-Culture to sustain its popularity, it must deeply penetrate global distribution networks and create synergy with other cultures,” adding, “We are devising various strategies such as holding events that link K-Beauty and K-Pop at offline cosmetics stores.”

Mergers and acquisitions (M&A) are also under consideration. Kim said, “Although annual sales from health functional foods and idol merchandise are in the range of 10 billion KRW, we are exploring mid-to-long-term acquisition opportunities in K-Food and K-Pop related companies to expand our business.” He added, “In 2020, we became the first in the K-Beauty industry to introduce Automated Guided Vehicles (AGVs) in logistics centers and have been striving to build smart factories.” The company plans to further advance smart factory capabilities and expand its logistics centers.